更多“Pay issuing bank's attenti…”相关的问题

更多“Pay issuing bank's attenti…”相关的问题

A. ( ) Obtain the issuing bank's agreement prior to paying the beneficiary.

B. ( ) Refuse the beneficiary's request while undertaking to pay at maturity.

C. ( ) Prepay the deferred payment undertaking.

D. ( ) Obtain an agreement for recourse to the beneficiary.

(1)( ) A only.

(2)( ) D only.

(3)( ) B and C only.

(4)( ) C and D only.

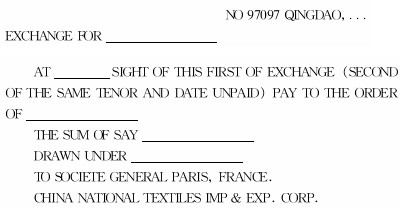

根据下列内容将汇票填制完整:

(1)Issuing Bank:Societe General Paris,France.

(2)L/CNo:7081 dated April 1st,2001

(3)L/c Amount:USD9996.00

(4)Applicant:A NAVY & CO.Hamburg.

(5)Advising Bank:Bank of China

(6)Beneficiary:China National Textiles Imp & Exp.Corp.

(7)Expiry date:May 31,2001

(8)B/L dated May 5th,2001

(9)B/L Beneficiary's draft at sight drawn on to the issuing bank and pay to the order of Bank of China for 98% value marked as drawn under the credit.

(10)Quantity of Goods:15000 Kilos net,unitprice USD 680.00 per 1000 Kilo.

(11)Invoice No:97097

The differences between a bill and a cheque are as follows:

Bill

(1)The drawee may be any person.

(2)There are four kinds of tenor for the bills.

(3)After acceptance the acceptor is primarily liable for payment.

(4)Before issuing a bill, the drawer may not open an account with drawee.

(5)A bill other than a banker's demand draft or stipulation in Article 5 of Cheque Act cannot be crossed.

(6) Acceptance made by acceptor is irrevocable.

(7)A bill can be drawn in a set.

Cheque

(1)The drawee must be a ______.

(2)The tenor is merely payable ______.

(3)The ______ is always primarily liable for payment.

(4)Before issuing a cheque, the drawer must be a customer who has opened an ______ with the paying bank and ______ money in the account.

(5)A cheque can be ______.

(6)Duty and authority of paying bank to pay a cheque may be terminated by ______.

(7)A cheque cannot be drawn in a ______.

Please fill the following particulars in a credit form to issue a Red Clause credit.

(1)issuing date: 6 June, 200×

(2)Credit No. 256734

(3)Credit amount: AUD64,000.00 (say Australian dollars...)

(4)expiry date: 31 July, 200×

(5)available with the advising bank by negotiation

(6)shipment date: 16 July, 200×

(7)special condition

"The Issuing Bank authorises the Negotiating Bank to pay 60% of the amount of the Credit in advance to the beneficiary against the following presentations:

Ⅰ. a receipt for the advance duly signed by the beneficiary;

Ⅱ. an undertaking from the beneficiary to utilize the funds to purchase and pack the goods;

Ⅲ. the undertaking of the beneficiary to present full set of documents as stipulated in the Credit to the Negotiating bank within the expiry of the credit.

After the advance payment has been made to the beneficiary, the Negotiating Bank may claim reimbursement to be supported by the receipt and undertaking on the Issuing Bank which will reimburse the negotiating bank immediately.

Upon negotiation of documents presented by the beneficiary, the advance payment for 60% of the credit amount will be deducted from the whole negotiating amount for beneficiary's refundment. The remaining approximate 40o-/o of the invoice value will be claimed by the Negotiating bank on the Issuing Bank for its reimbursement. "

Red Clause Credit

Name of Issuing Bank Place and date of issue

Bank of Australia, London, (1) ____________

Name of Beneficiary Advised through

To: Marlin Wool Company, Melbourne Bank of Australia, Melbourne

Dear Sirs,

At the request and on the instructions of (name and address of the applicant), we hereby issue an Irrevocable Documentary Credit No. (2) ______ for (3) ______ (say ____________) to expire on or before (4) ______ at Melbourne (5) __________________ of your draft for 40% of the invoice value drawn at sight on us against the presentation of the documents detailed herein:

① Commercial invoice in triplicate.

② Full set clean on board ocean bills of lading made out to order endorsed in blank marked "freight prepaid".

③ Packing list in triplicate.

Evidencing shipment from London to Melbourne not later than (6) ______.

Partial shipments not allowed. Transhipment allowed.

(7)Special condition

____________________________________________________________

____________________________________________________________

Instructions to the Negotiating Bank

All shipping documents in compliance with the terms and conditions of the credit shall be forwarded by you immediately to us for beneficiary's refundment of 60% advance payment and claiming your reimbursement of 40% invoice value.

We engage with drawers and bona-fide holders of draft (s) drawn under and negotiated in compliance with the terms and conditions of the credit that such draft (s) shall be duly honoured upon due presentation.

This Credit is subject to UCP 600.

Yours faithfully

Bank of Australia,

London

dignature(s)

(1)( ) Fraud by the beneficiary.

(2)( ) Insolvency of the issuing bank.

(3)( ) Refusal of the issuing bank to pay against complying documents.

(4)( ) Government restrictions on funds transfer from the issuing bank.

Disposition of discrepant documents by the nominated bank in the following six methods:

(1) ( )Return just the discrepant documents for correction and resubmission within the

validity of the Credit and within the latest date for presentation of above document.

(2) ( )Upon authorization by the presenter, forward the discrepant documents on "an approval" basis under documentary credit to the Issuing Bank for review and approval or rejection of the documents.

(3) ( )If so authorised by the presenter, cable, telex, or telecommunicate with the issuing bank for authority to pay, accept, or negotiate against such discrepant documents.

(4) ( )Remittance of Documents for Collection.

(5) ( )Call for an indemnity from the beneficiary or from his bank, pay, accept or negotiate on the undertaking that any payment, acceptance or negotiation made, will be refunded by the party giving such indemnity together with interest and related charges, if the issuing bank refuses to provide reimbursement.

(6) ( )With the agreement of the beneficiary, pay, accept or negotiate "under reserve", i. e. the bank retains the right of recourse against the beneficiary if the issuing bank refuses to provide reimbursement against documents that do not meet the credit requirements.

如果结果不匹配,请

如果结果不匹配,请