题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

中央银行独立性(central bank independence)

中央银行独立性(central bank independence)

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

中央银行独立性(central bank independence)

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“中央银行独立性(central bank independe…”相关的问题

更多“中央银行独立性(central bank independe…”相关的问题

Show how an expansion in the central bank's domestic assets ultimately affects its balance sheet under a fixed exchange rate.How are the central bank's transactions in the foreign exchange market reflected in the balance of payments accounts?

描述非预期贬值对中央银行资产负债表和国际收支账户的影响。

Describe the effects of an unexpected devaluation on the central bank's balance sheet and on the balance of payments accounts.

Why might EMS provisions for the extension of central bank credits from strong-to weak-currency members have increased the stability of EMS exchange rates?

“When domestic and foreign bonds are perfect substitutes,a central bank should be indifferent about using domestic or foreign assets to implement monetary policy.”Discuss.

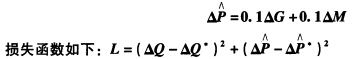

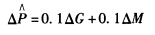

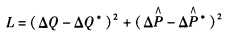

当中央银行不改变货币政策时,政府希望不改变产出水平,又能降低通货膨胀2%时的最佳财政政策是什么?损失函数的值是什么? c.如果中央银行愿意合作,最佳政策组合是什么?损失函数的值多大? In some countries,the central bank is independent from the government.Consider a situationin which the government wants to reduce inflation without changing output,but the central bank would not change monetary policy. a.Can the government achieve its objectives by using only fiscal policy?Why? b.Assume that the effect of instruments on targets in this economy are represented by the following model(in deviations from the baseline):

当中央银行不改变货币政策时,政府希望不改变产出水平,又能降低通货膨胀2%时的最佳财政政策是什么?损失函数的值是什么? c.如果中央银行愿意合作,最佳政策组合是什么?损失函数的值多大? In some countries,the central bank is independent from the government.Consider a situationin which the government wants to reduce inflation without changing output,but the central bank would not change monetary policy. a.Can the government achieve its objectives by using only fiscal policy?Why? b.Assume that the effect of instruments on targets in this economy are represented by the following model(in deviations from the baseline):

and the loss function is

and the loss function is

What is the optimal fiscal policy that the government should pursue when its objectives are to reduce inflation by two points without changing the level of output,if the central bank does not change monetary policy?What is the value of the loss function? c.Assume nOW that the central bank decides to cooperate.What is the optimal policy mix?What is the value of the loss function?

What is the optimal fiscal policy that the government should pursue when its objectives are to reduce inflation by two points without changing the level of output,if the central bank does not change monetary policy?What is the value of the loss function? c.Assume nOW that the central bank decides to cooperate.What is the optimal policy mix?What is the value of the loss function?